Have questions? We’ve got answers. Here are the most common questions to help you understand and complete your Living Trust with confidence.

No Documents Needed

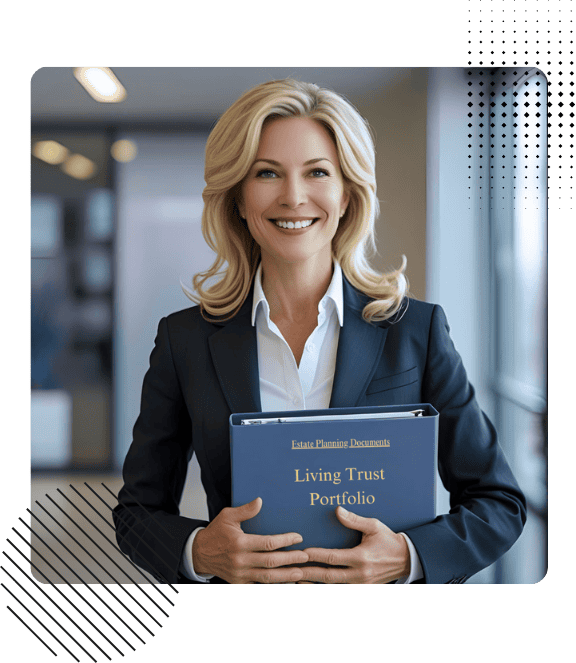

Create your personalized living trust in just 30 minutes. We'll handle the paperwork and deliver it to your door in just a few days, so you can secure your legacy without the hassle.

It's shocking that 67% of families don't have a Living Trust. I started EZ Living Trust to help all families afford a Trust and Estate Plan to prepare for the future and avoid probate of their home.

Our state of the art online software navigates you through the entire process to help you do it on your own, bringing down the cost dramatically. With transparent pricing and no hidden fees, you get a clear, straightforward solution for your estate planning need -- ensuring peace of mind at every step.

We use the same trusted legal documents many attorneys rely on—at a much lower cost. While other companies may surprise you with upsells for essentials like Quit Claim Deeds or Advance Health Care forms, we believe in transparency. Everything you need is included in one affordable price, with no hidden fees.

Discover how our clients have transformed their estate planning experience with us. Read their testimonials to see how we've made securing their future simple and affordable.

A Living Trust is a legal document that allows you to place your assets—such as property, bank accounts, and investments—into a trust during your lifetime. You can manage these assets as the trustee while you're alive, and you can also specify how they should be distributed after your death. Your Successor Trustees are pre-authorized to step in if you are medical unable or after your death.

No, you don’t need an attorney to make a living trust, especially if your estate is simple. You can use online tools like EZ Living Trust. However, if your estate is large or complex, an attorney can help ensure everything is set up correctly. They can also give advice on taxes and legal issues to avoid mistakes.

After creating a living trust, follow these steps:

A revocable living trust doesn’t directly save on taxes, but it can help reduce estate taxes by managing how assets are passed to beneficiaries. It doesn’t protect your assets from creditors while you're alive, but after your death, the trust can provide some protection for your beneficiaries from their creditors. For full protection from creditors, other legal tools like an asset protection trust may be needed.

A revocable living trust doesn’t directly save on taxes, but it can help reduce estate taxes by managing how assets are passed to beneficiaries. It doesn’t protect your assets from creditors while you're alive, but after your death, the trust can provide some protection for your beneficiaries from their creditors. For full protection from creditors, other legal tools like an asset protection trust may be needed.

Get clear, expert tips on estate planning and Living Trusts—made simple so you can plan with confidence.

EZ Living Trust is a division of Strategic Choices Financial, Inc. Neither is a law firm and cannot provide legal or tax advice. The information on this site is for informational and educational purposes only.

Strategic Choices Financial, Inc, dba EZ Living Trust is registered as a Legal Document Assistant in Los Angeles County, CA #987456, and is licensed and bonded.